By Sheryl L. Rowling

(Before I begin this column, I must apologize for my recent truancy as a columnist. Please have a little rachmones for me– I was busy attending conferences! As a result, I was able to fill my brain with tidbits that I hope you will find useful!)

SAN DIEGO — We are faced with much financial uncertainty these days. As we begin to think about year-end tax planning, an overriding question lurks: With unpredictable tax laws, how can we plan? I have some suggestions, but first, let’s consider where we stand now.

Legislation passed in December 2010 provided a short reprieve from the high level of uncertainty by retaining the current lower tax rates through 2012. Even assuming that we can count on the current tax rules through 2012 (which is never a definite), what happens beyond that is subject to much debate in the political arena.

The reasons are plain to see: The Federal deficit and national debt continue to grow, and the U.S. economy continues to struggle. Although budget cuts might make a dent in the deficit, tax reform of one kind or another is sure to be part of the package.

Unfortunately for planning purposes, no single tax reform proposal has garnered majority support. And, the looming sunset of the Bush-era tax cuts at the end of 2012 only compounds the situation.

Although no one can predict the outcome of the debate, there are a few uncertainties and certainties that should be considered when planning for taxes.

The big uncertainty is: Which way will tax rates go? The Democrats believe that raising taxes is required to begin to repay the deficit. Republicans believe in the “trickle down” theory, proposing lower tax rates to stimulate the economy. President Obama’s jobs bill includes a 5.6 percent surtax on an individual’s earnings in excess of $1 million, informally known as the “Buffet Rule.” Republicans have introduced their own jobs plan, which features a reduction in both individual and corporate tax rates, to 25 percent.

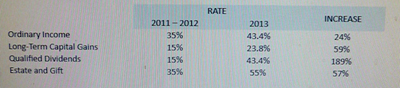

How can you plan in this environment? The silver lining in this cloud of uncertainty is that taxpayers still have the benefit of relatively favorable income, gift, and estate tax rates for the remainder of 2011 and 2012. We also know that tax rates are scheduled to increase and various tax benefits are scheduled to sunset by the end of 2012. Also lurking on the horizon is a new 3.8 percent surtax on net investment income and an increase in the Medicare payroll tax of 0.9 percent, both of which arose out of 2010’s health care legislation. These come into play in 2013 for individuals with adjusted gross income (AGI) above $200,000 and married couples filing jointly with AGI over $250,000. All of this creates a tidal wave of tax changes, as highlighted in the chart below, and makes 2011 and 2012 very important for tax planning to ensure that you can blunt the wave’s impact.

TOP TAX RATES

In the articles to follow, I will present planning ideas to consider before the end of this year and into 2012. In light of the complexity of these issues and the possibility of unforeseen changes on the horizon, please consult your tax professional before undertaking any major tax planning actions. I also acknowledge Moss Adams LLP for providing much of the content in this article from its Year-End Tax Planning Guide . You may also visit www.mossadams.com to stay abreast of any late-breaking tax changes that might affect you or your business.

Any tax advice contained in this article, unless expressly stated otherwise, was not intended or written to be used, and cannot be used, for the purposes of (i) avoiding tax-related penalties that may be imposed on the taxpayer under the Internal Revenue Code or applicable state or local tax law of (ii) promoting, marketing or recommending to another party any tax-related matters addressed herein.

*

Sheryl L. Rowling, CPA/PFS, partner of Moss Adams Wealth Advisors LLC, has been providing tax, financial planning and investment advice for over 30 years, since 1979. She may be contacted at sheryl.rowling@sdjewishworld.com