By Sheryl Rowling

SAN DIEGO — As an investment adviser, I am often asked questions like: “What kind of return will we get this year?” “Is the marker heading for a big downturn?” “Are we about to experience a rally?” Answers to these questions really take a crystal ball. Unfortunately, nobody has found one that works yet.

The simple truth is that the market will have ups and downs and the timing cannot be predicted – at least not consistently. (Once in a while, an “expert” will guess right.) The best way to weather volatility is with diversification – holding many different types of investments so that when some pieces decline in value, other pieces increase in value. This is called “negative correlation.” The closer you can get to “perfect” negative correlation, the closer you will be to achieving an ongoing, consistent return. A simple example is holding stocks and bonds. These two investment types often react differently to economic events. Thus, a drop in stock prices could be partially offset by an increase in bond prices.

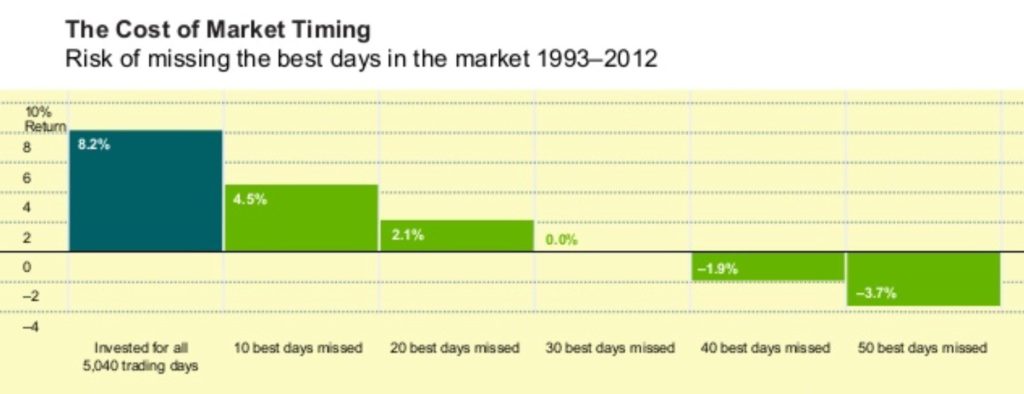

Trying to time the market just doesn’t work. Getting out of the market right before it drops and getting back in right before it takes off requires you to be right twice. You have to know exactly when to get out and in. Think about it: Could anyone realistically know that tomorrow will be higher or lower than today? Because upturns in the market tend to come in short spurts, missing out on even one day of a rally could hurt your returns in a big way. If fact, looking at an analysis from 1993 – 2012, being out of the market on even 20 of the best days over 20 years drops performance Fromm 8.2% to 2.1%. See the chart below for the details.

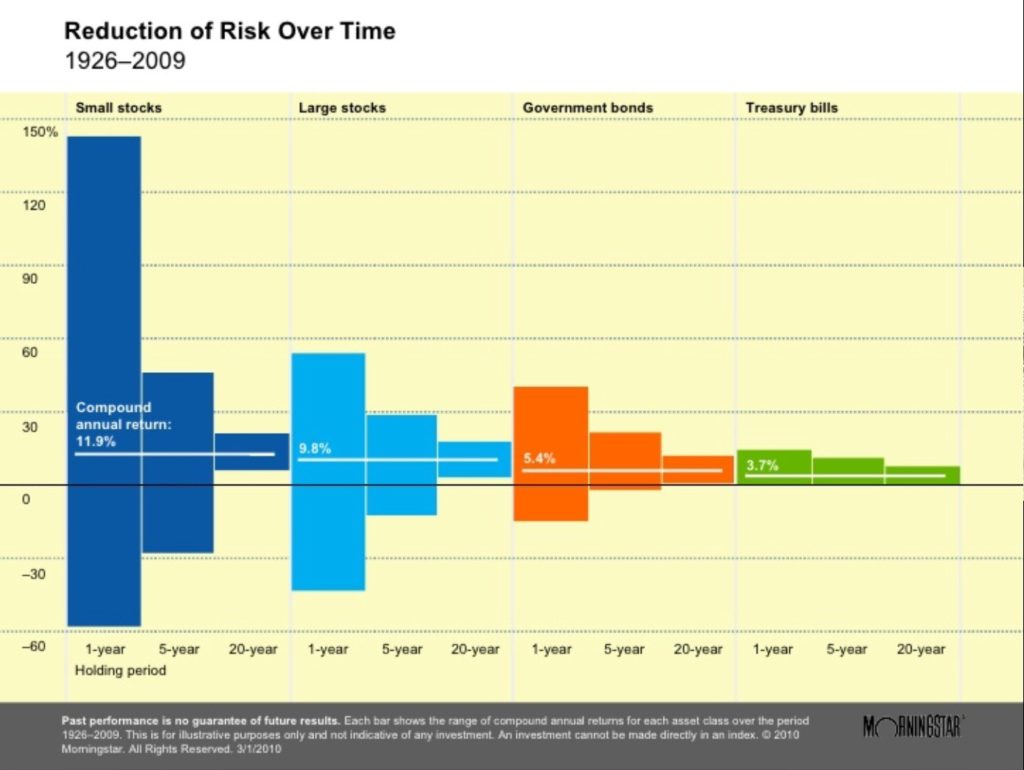

Time, not timing, will achieve the greatest long-term returns. As seen from the chart below, holding investments for twenty years essentially eliminates the chance of loss.

So, when I’m asked whether the market is going up or down, I answer “yes.” Diversification and staying in for the long-term might seem unexciting. However, it is the best way to achieve the benefit of long-term market returns.

*

Rowling is a certified public accountant, personal finance specialist, and principal of Rowling & Associates. She may be contacted via sheryl.rowling@sdjewishworld.com. Comments intended for publication in the space below must be accompanied by the letter writer’s first and last name and by his/ her city and state of residence (city and country for those outside the U.S.)