By Donald H. Harrison

SANTEE, California – County Assessor-Recorder-County County Clerk Jordan Zev Marks, who is the son of a rabbi, is urging religious institutions to consider utilizing their favorable tax status to build much-needed affordable housing and child care centers.

During a tour of Marks’ triple-responsibility offices in Santee, where property, birth, marriage, and death records are stored in temperature- and humidity-controlled archives, Marks noted that attendance at many houses of worship is declining, creating financial hardships for the congregations.

Building affordable housing, he said, is an example of “how do you take advantage of doing the right thing and also develop a revenue source that can sustain the churches and synagogues.”

Under California law, houses of worship are exempt from property taxes. Specified projects, such as housing for seniors or low income residents, can also be exempt from property taxes, providing that the saving are passed along to the residents, Marks said.

He said that he has met with several Chabad leaders, including Rabbis Yonah Fradkin and Yeruchem Eilfort, to discuss the possibilities, and also has met with Catholic and Episcopal clergy and board members.

Along with a non-profit group known as YIGBY –Yes in God’s Back Yard – Marks said he tells the religious leaders, “We think you could take advantage of this. Here is the program and how it works, and this is why you should be leaning into these opportunities.”

Typically, when religious organizations are considering developing affordable housing, “they bring me in to talk to their board of directors who tend to be more conservative fiscally, and want to know ‘what are our liabilities, what if this doesn’t happen?’ My office has been able to issue letters spelling out their concerns and this moves the process forward.”

Additionally, “We’ve partnered with City Council members and other folks and have said ‘Here we need housing, here are folks in your district, talk to them, tell them you want to help them with their permits, their costs.’”

Marks, who has dual membership at Congregation Beth El in La Jolla and at Chabad at La Costa, said the latter congregation, potentially could create a child care center in Carlsbad, a city which he described as “a desert of child care.” He noted that Chabad at La Costa is in the process of fundraising to build out the basement level of its synagogue.

Generally speaking, “if you are a nonprofit and you are offering child care, we can reduce your property taxes and pass that savings onto the families,” Marks said.

Elected last November to the non-partisan, triple-role office, Marks, 42, previously served as chief deputy assessor and taxpayer advocate under his predecessor Ernie Dronenburg, with whom he had a friendship before joining the office. Marks is the 37th assessor in the county’s history.

The son of Orthodox Rabbi Michael Marks, who also is an attorney in New York, and the nephew of Chabad Rabbi Chaim Goldberg of Toronto, Canada, Marks grew up in Los Angeles with his single mother, Carrie, a Hebrew-language calligrapher whose ketubahs have been collected by museums. He attended Hamilton High School and later Beverly Hills High School. Interested in politics at an early age, after graduation from high school, he spent a year working in New Hampshire in the unsuccessful Republican presidential campaign of publishing executive Steve Forbes. Afterwards, he followed to San Diego County his older brother Darren, who at the time was a student at Cal State San Marcos.

Marks enrolled at MiraCosta College, attending classes at two campuses in Oceanside and the San Elijo campus in Encinitas to represent all the students as the community college’s student president and student trustee. After graduating with an associate’s degree in 2004, he enrolled at UCLA, obtaining a bachelor’s degree in political science in 2006. A highlight of his UCLA program was a summer trip for academic credit through Europe, during which he met Eva Moreno, his future wife. They both traveled to the U.S. East Coast to attend law school, Eva at Howard University in Washington D.C., and Jordan, initially, at the Buffalo campus of the State University of New York. Adverse to Buffalo’s extremely cold winters, Marks took advantage of opportunities to study at a campus in New York City, and then go on a law school exchange program to study in Tokyo. He received his law degree in 2009.

Joining his wife-to-be in Washington D.C., he tried out several jobs, including service with the House Committee on Financial Services and creating his own consulting firm for non-profit organizations. He decided to move with her back to California after he was offered a job on the staff of then state Sen. Joel Anderson (R-El Cajon) who today is a San Diego County Supervisor. While working for Anderson, Marks passed the California Bar exam. He then went to work in the government relations division of the California Realtors Association, and later was appointed by Gov. Jerry Brown to serve as a district director for the state Board of Equalization.

“Yes,” Marks smiled. “Jerry Brown appointed Republicans too.”

“I was traveling the state quite a bit, probably put 60,000 miles on my car in three years with numerous trips to Sacramento and across the state,” Marks said. During that period, Marks developed a warm friendship with Ernie Dronenburg, who had been a member of the governing body of the Board of Equalization, and had since moved on to become San Diego County’s tax assessor.

“He said, ‘I’ve wanted a taxpayer advocate for the longest time but I’ve never had the right person, but you’re a lawyer, you’re familiar with appraisal, you have the heart for helping folks; I’d like you to join my team.’ So, [in 2017] I came onto his executive team and then moved up to chief deputy assessor and taxpayer advocate. I decided to run when he retired.” Marks defeated former San Diego City Councilwoman Barbara Bry for the position in last November’s election, garnering 452,353 votes or 51.51 percent to Bry’s 425,913 votes.

Dronenburg was more than a mentor to Marks; he was also the officiant at the 2013 wedding of Marks and Moreno, who had been living together for eight years. Marks surprised Moreno with the wedding, telling her they were going to a progressive party at which everyone was supposed to wear white. He said the first stop was the “Kiss” statue next to the USS Midway, where he surprised her by bending to his knee and formally proposing. In a limousine that friends who accompanied them hired for the occasion, Marks told Moreno that he wanted the wedding to be that very day. She protested that she wanted their families in attendance. Secretly, Marks had taken care of that – her family, who operate a tamale factory in in Riverside, and his family were waiting for them at the entrance to the San Diego County Administration Building, where they took out their marriage license. Then they crossed the road to the ferryboat Berkeley, where Dronenburg conducted the ceremony. The couple subsequently had a Jewish wedding officiated by Rabi Avi Libman of Congregation Beth El. Today Jordan and Eva have a son, David.

Marks said that Dronenburg and his predecessor, Greg Smith, set a high standard for customer service in the Assessor-Recorder-County Clerk’s (ARCC) office, with the goal being to make no customer wait more than 10-15 minutes before they are served. The Santee office is one of five in the county, with the others being located by the downtown waterfront, in Kearny Mesa, Chula Vista, and San Marcos. The air-conditioned office features a large colorful mural by artist Christine Nguyen across the back wall of the reception area. Called “Mountains to Sea,” it is described as a dye sublimation on aluminum and is accompanied by a hanging mobile that Nguyen calls “Water Poem for the Sky.” Marks said the companion pieces of art give the Santee office a “warm, welcoming feeling.”

Not only does his office issue marriage licenses, personnel there – including Marks – are credentialed to perform wedding ceremonies. A happy wedding party was just leaving the premises when I arrived for a 2:30 p.m. interview with Marks. There is one room for wedding parties to assemble, or perhaps wait while someone else’s wedding takes place, and another room where the ceremony can be conducted. One wall is covered with bright images of eastern San Diego County, a photographer’s must-shoot alongside the wedding couple. There also is the option to hold the wedding under an outdoor arbor, with the brown foothills and mountains as a backdrop.

As you walk into the reception area of the Santee facility at 10133 Mission Gorge Road, the offices on the right are those of tax appraisers, the people who set the value of your property; while the offices on the left are for the county recorder and clerk operations, which are mainly matters of record keeping and records preservation. Benches between the two areas provide seating for people while they wait to be served.

Marks said approximately 91 percent of the county’s 1,013,000 residential property parcels are covered by California’s Proposition 13, the 1978 ballot initiative that said the assessed valuation of a property cannot increase by more than 2 percent unless its status is changed by new construction, a sale, a change of ownership, or a death. The other 9 percent of the properties are subject to case-by-case valuations. After a determination has been made of the value of a property, the county’s auditor-controller looks at what tax obligations have been put onto that property by local governments, and then sends the total obligation to the tax collector’s office. For convenience sake, there is a small component of the tax collector’s office sharing space at the assessor’s offices.

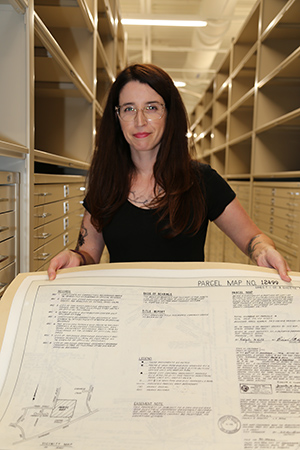

All of the county’s property records, including maps, are being brought from other locations to the archives in Santee. Especially old records dating as far back as 1850, when California became a U.S. state, are frozen for a period of time to kill any insects or rodents that may have burrowed into their storage boxes. Then the records are defrosted and filed on shelves that are connected to moveable walls that can be compressed when not in use. This maximizes the amount of space available for record-keeping. A ceremony naming the archive’s reading room after Dronenburg is planned on October 25.

Personnel can be reallocated in the Assessor-Recorder-Clerk’s office depending on the demands of the moment. For example, Marks said, during the COVID pandemic, interest rates went down to between 2 and 3 percent, prompting many homeowners to refinance their homes. Personnel was shifted to the recorders office, allowing more people to get their new interest rates promptly recorded. “The timing was important,” Marks said, “If anyone has ever closed on a home or a re-fi, you’re on this 30-day deadline to get it done. In our office, if you are in by 3 p.m., we guarantee that we will record that document the same day. Some offices could take five days and that could be the difference between a rate shirt, or a deal going bad – a lot of things can happen.” The Assessor-Recorder-Clerk’s office is open Monday through Friday from 8 a.m. to 5 p.m.

The assessor’s side tends to attract the most traffic. “The public interacts with their property tax bill and that interaction generates the most questions, the most education needs,” Marks explained

*

Donald H. Harrison is editor emeritus of San Diego Jewish World. He may be contacted via donald.harrison@sdjewishworld.com